Testing Claude Opus 4.6: Finance Skill

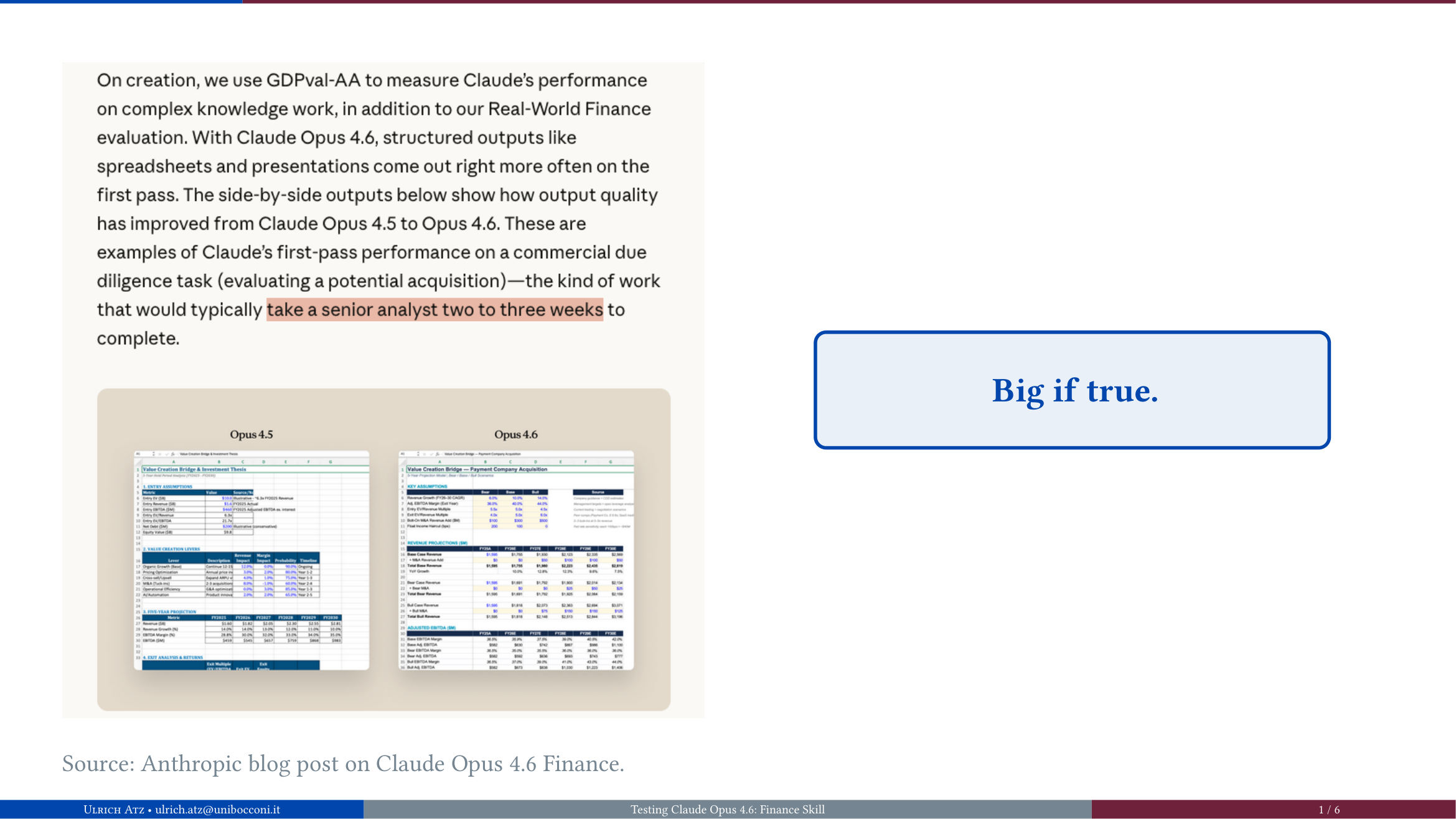

Today, Anthropic released Claude Opus 4.6 with a dedicated Finance plugin. They claim this tool can save 2–3 weeks of a senior analyst’s work. I tested it on a real task: capitalizing Volkswagen’s R&D expenses from their 2024 Annual Report (677 pages).

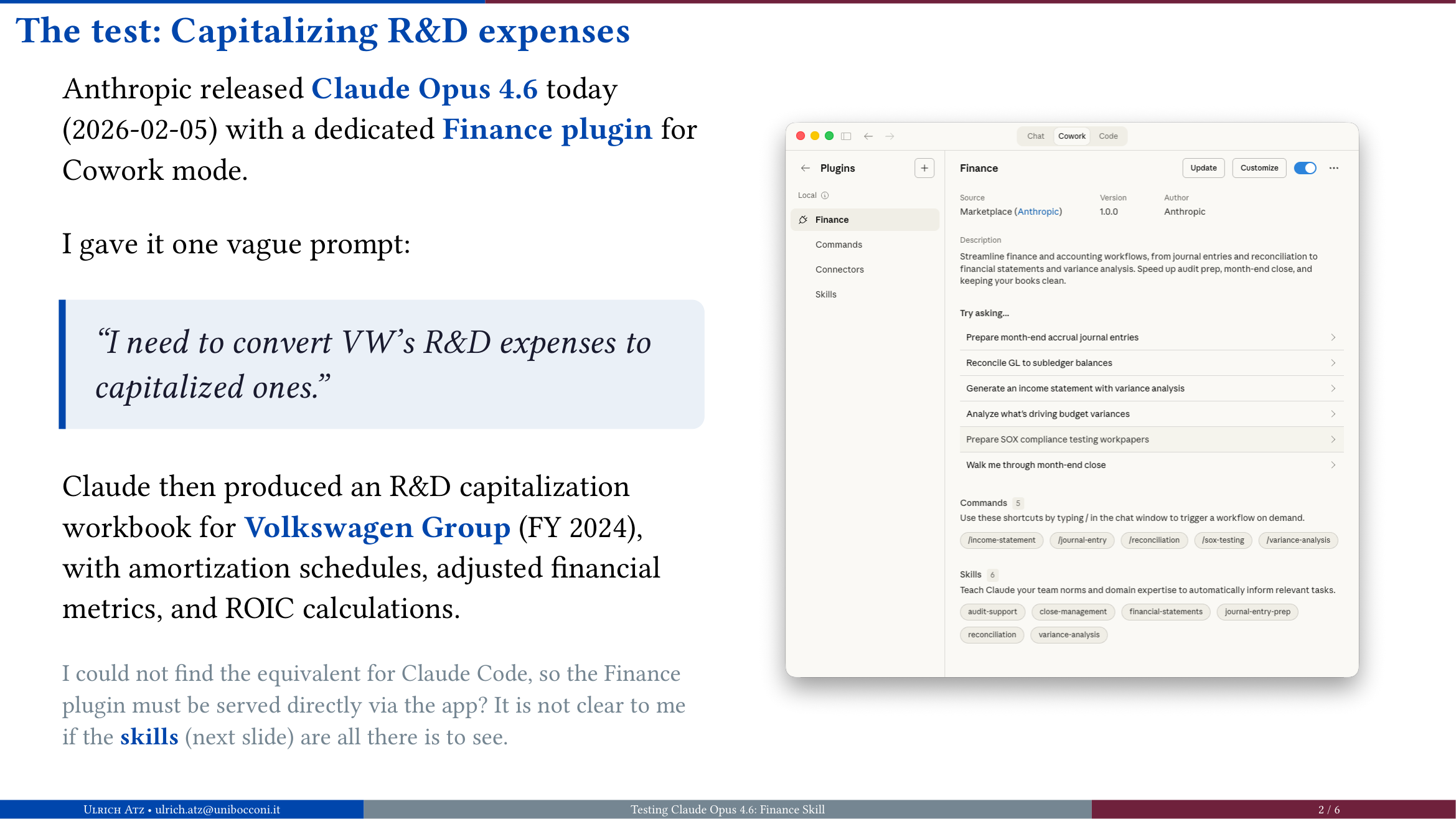

I gave it one extra-vague prompt: “I need to convert VW’s R&D expenses to capitalized ones.” My students get a better version of this instruction when I teach this in class, rest assured.

The test

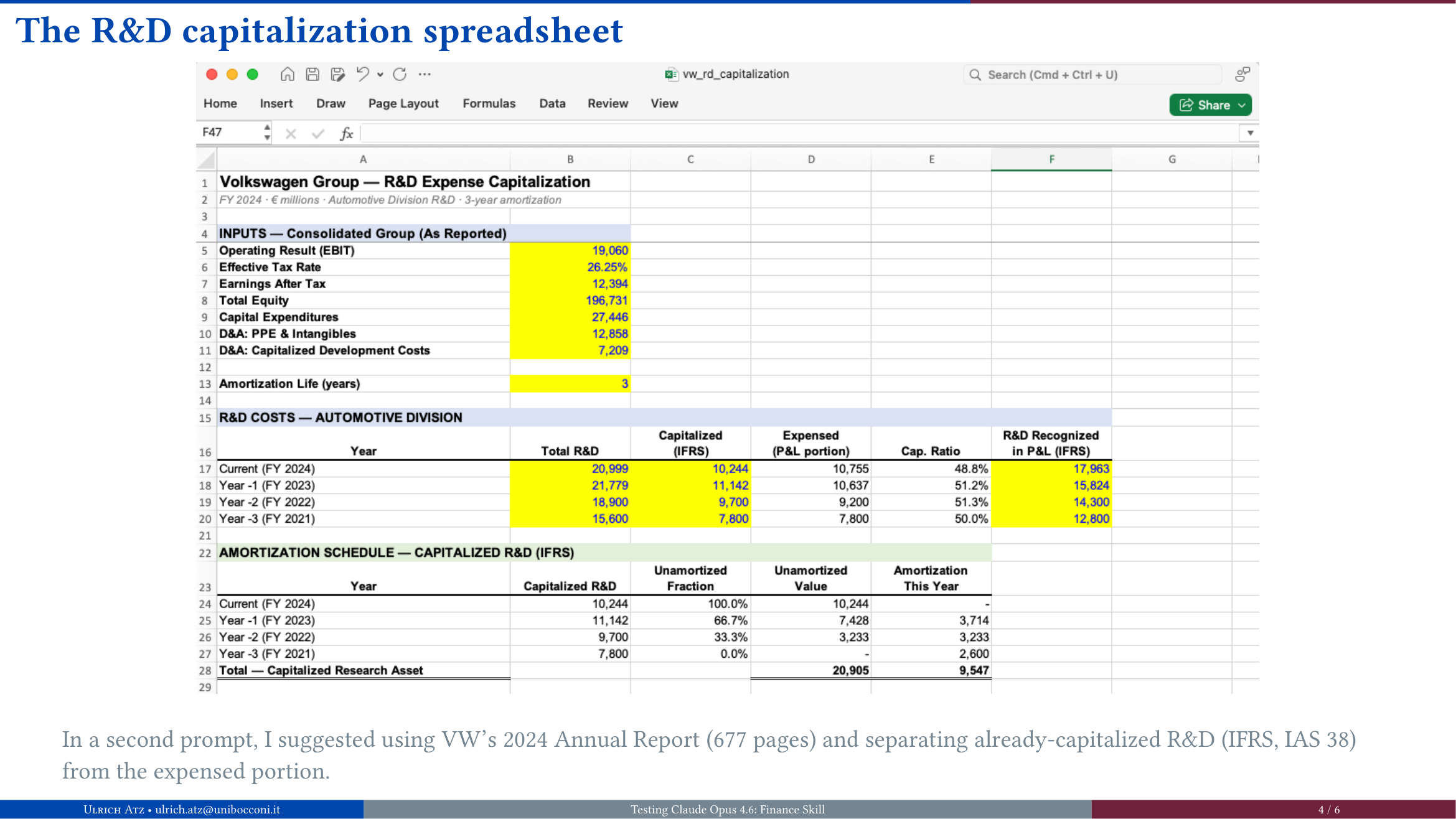

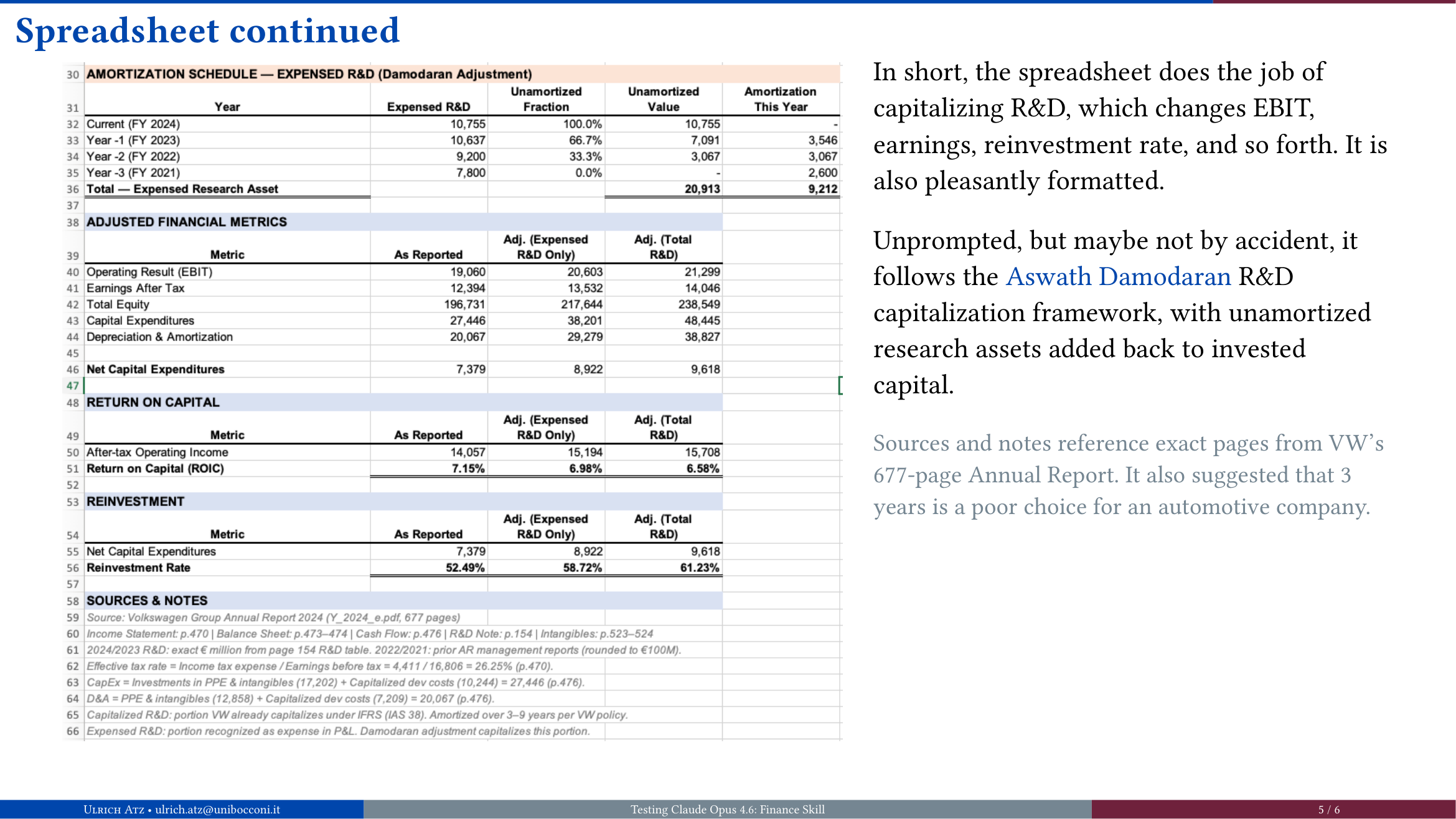

Following my prompt, Claude produced a full R&D capitalization spreadsheet with amortization schedules, adjusted financial metrics, and ROIC calculations.

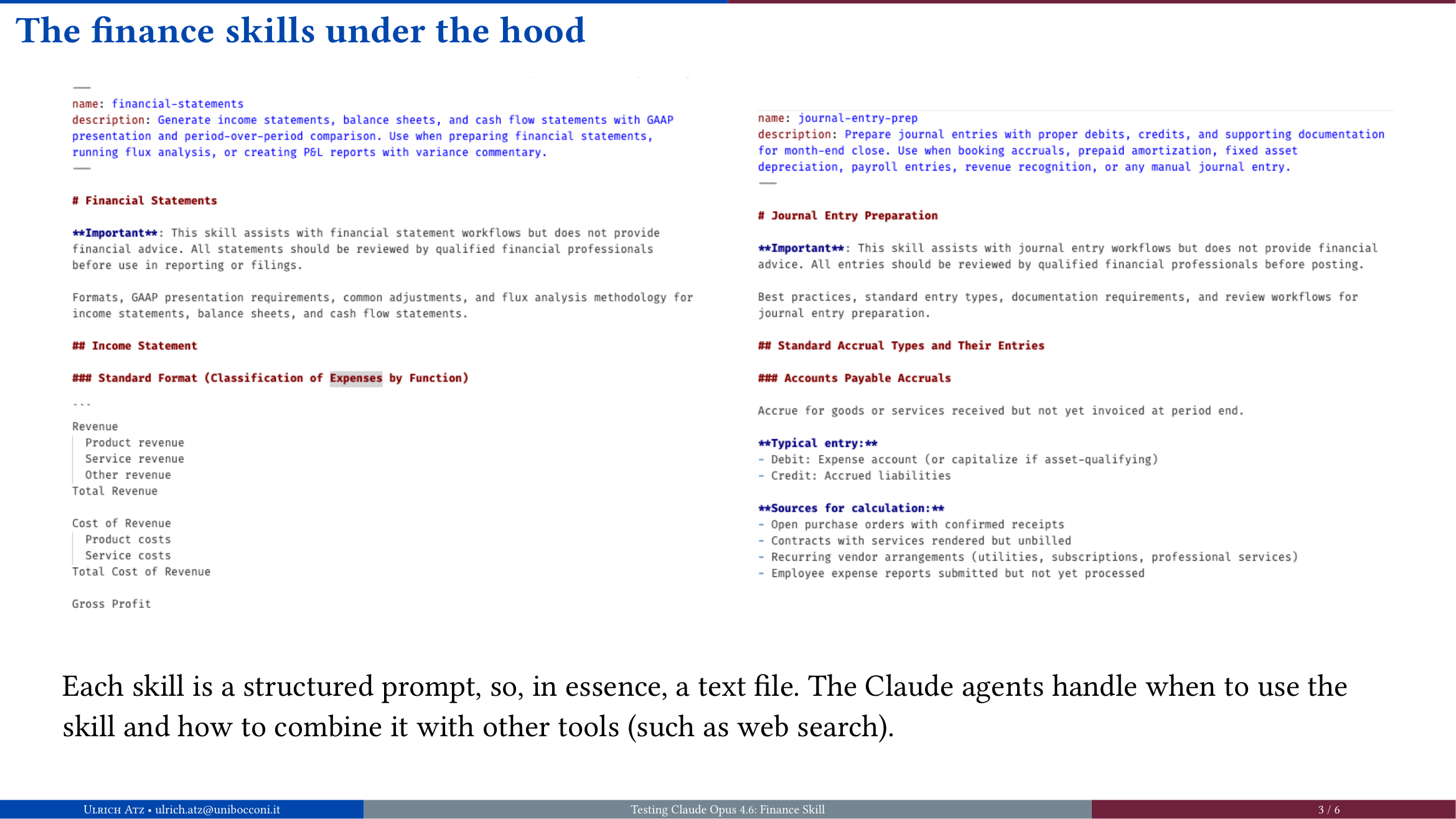

The finance skills under the hood

Each skill is a structured prompt, so, in essence, a text file. The Claude agents handle when to use the skill and how to combine it with other tools (such as web search).

The R&D capitalization spreadsheet

In a second prompt, I suggested using VW’s 2024 Annual Report and separating already-capitalized R&D (IFRS, IAS 38) from the expensed portion. Unprompted, which is funny to me, it followed the framework from Aswath Damodaran. It flagged that a 3-year amortization period is a poor choice for an automotive company, which is a good call.

Claude still needs guidance

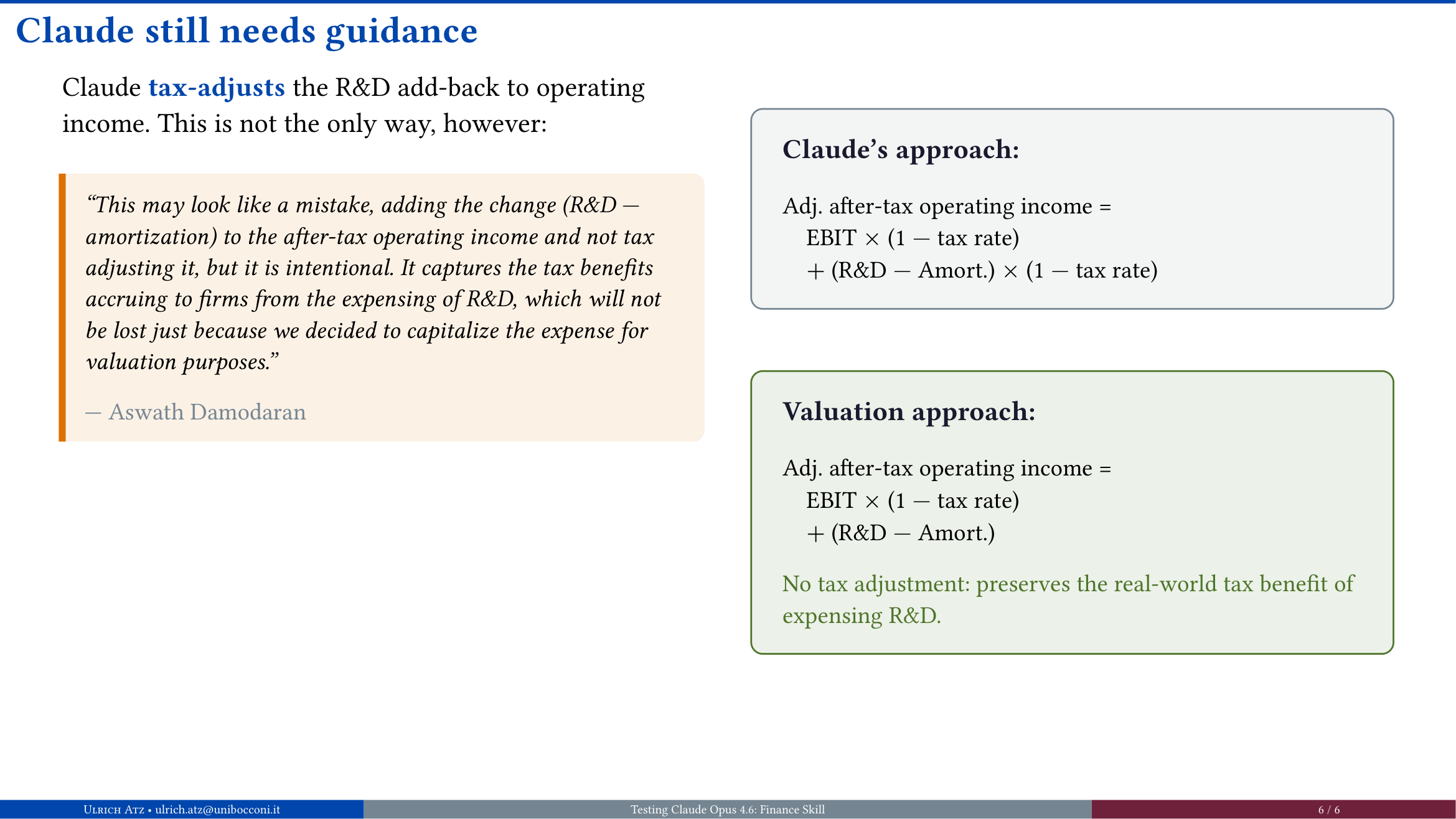

Claude tax-adjusts the R&D add-back to operating income. This is not the only way. Damodaran argues that the tax benefits accruing to firms from expensing R&D should be preserved, not adjusted away. Even though it seemed to follow the framework, you would need to really know your R&D capitalizing to make an informed decision.

Takeaway

The usual pros and cons apply als for Claude Finance (as of today): it is remarkably fast and capable, but still requires supervision and will make mistakes. There is also a Claude plugin in Excel. When I tried it, it failed to count 21 rows. I have video proof but with confidential data, so you’ll have to trust me on this one.

The spreadsheets look very good though.