Does Sustainability Generate Better Financial Performance? Review, Meta-analysis, and Propositions

(with Tracy Van Holt, Zoe Liu, and Chris Bruno), Journal of Sustainable Finance and Investment

ACCESS THE PAPER HERE, the pre-print version, the online appendix, and the replication package

Abstract

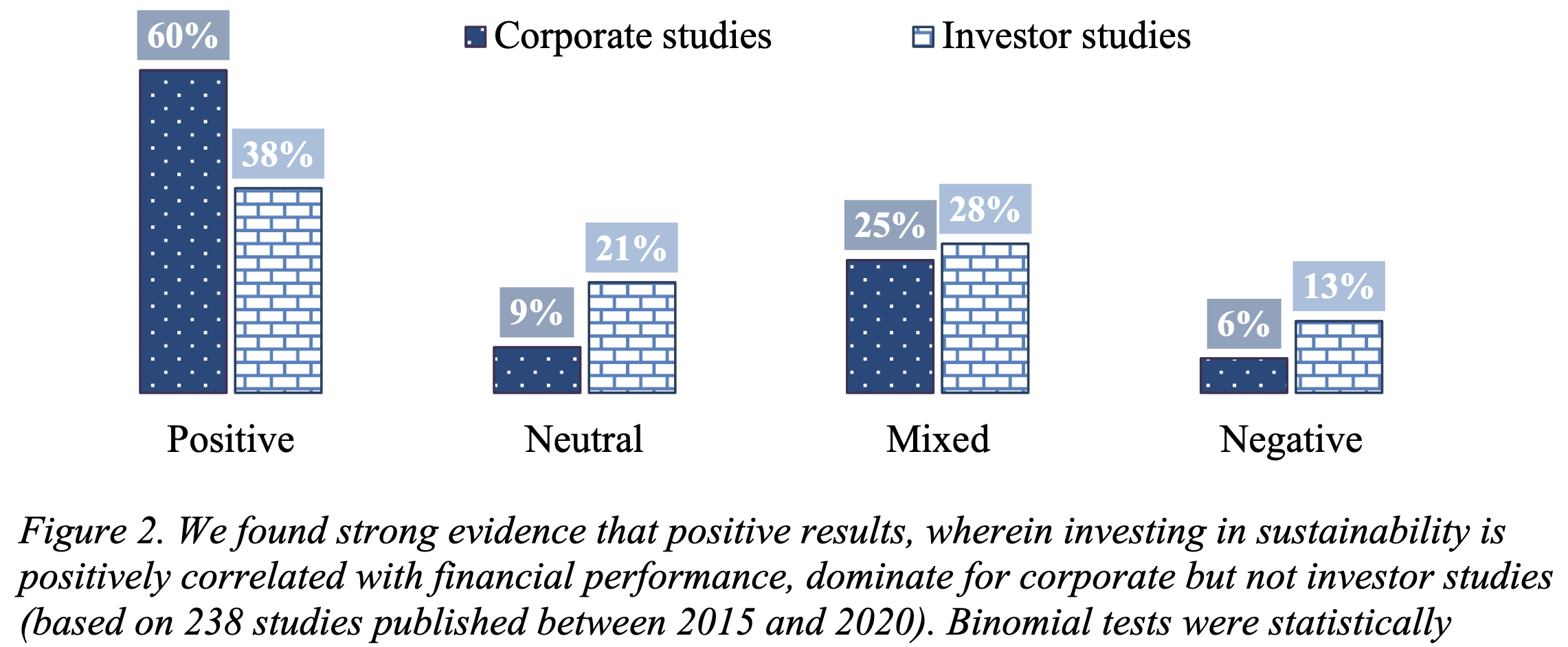

Sustainability in business and ESG (environmental, social, and governance) in finance have exploded in popularity among researchers and practitioners. We surveyed 1,141 primary peer-reviewed papers and 27 meta-reviews (based on ~1,400 underlying studies) published between 2015 and 2020. Aggregate conclusions from a sample suggest that the financial performance of ESG investing has on average been indistinguishable from conventional investing (with one in three studies indicating superior performance) – in contrast with research in the wider management literature as well as industry reports. Until recently top finance journals did not publish climate change related studies, yet these studies capture the frontier of corporate risk and ESG investment strategies. We developed three propositions: first, ESG integration as a strategy seems to perform better than screening or divestment; second, ESG investing provides asymmetric benefits, especially during a social or economic crisis; and third, decarbonization strategies can potentially capture a climate risk premium.

Useful things

- Twitter thread summary

- Summary blog post at Columbia Law School Blue Sky Blog

- Summary article in German at Absolut|impact #2/2021

More content

- Presentation at CFA Society UK

- Discussion with IR Magazine (video)

- Some corporate mentions: McKinsey Quarterly · KPMG · Deloitte

- Some media coverage: Financial Times · Forbes · Fast Company · Investor Daily · IR Magazine · Responsible Investor · investESG