Going Dark: Incentives for Private Firms’ Strategic Nondisclosure

(with Massimiliano Bonacchi and Ilan Guttman), SSRN

Abstract

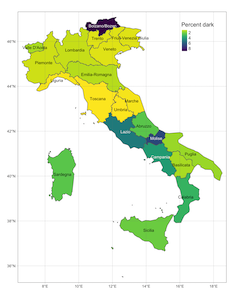

We study the disclosure incentives of private firms and document a U-shaped nondisclosure pattern in performance, i.e., private firms tend to disclose intermediate news and conceal extreme good or bad news. This finding is consistent with the intuitive idea that various stakeholders react much stronger to extreme news (either good or bad news), which results in higher proprietary costs to the disclosing firm. Private firms face substantially lower capital market incentives and agency costs compared to public firms, which enables to better identify their proprietary costs. We exploit the Italian setting where: 1) private, limited liabilities firms have to annually file their financial statements; and, 2) we can observe the years before a firm stops disclosing and investigate the manager’s choice to go dark (i.e., to stop disclosing). Failing to do so, however, results in a minuscule fine – which makes it a de facto voluntary disclosure setting. In two cross-sectional analyses we find that both higher ownership concentration as well as a higher owner’s preference for financial privacy increase the likelihood of a firm to go dark.

Useful things

- Slide deck available upon request