The Return on Sustainability Investment (ROSI): Monetizing Financial Benefits of Sustainability Actions in Companies

(with Elyse Douglas, Tracy Van Holt, and Tensie Whelan), Review of Business

Abstract

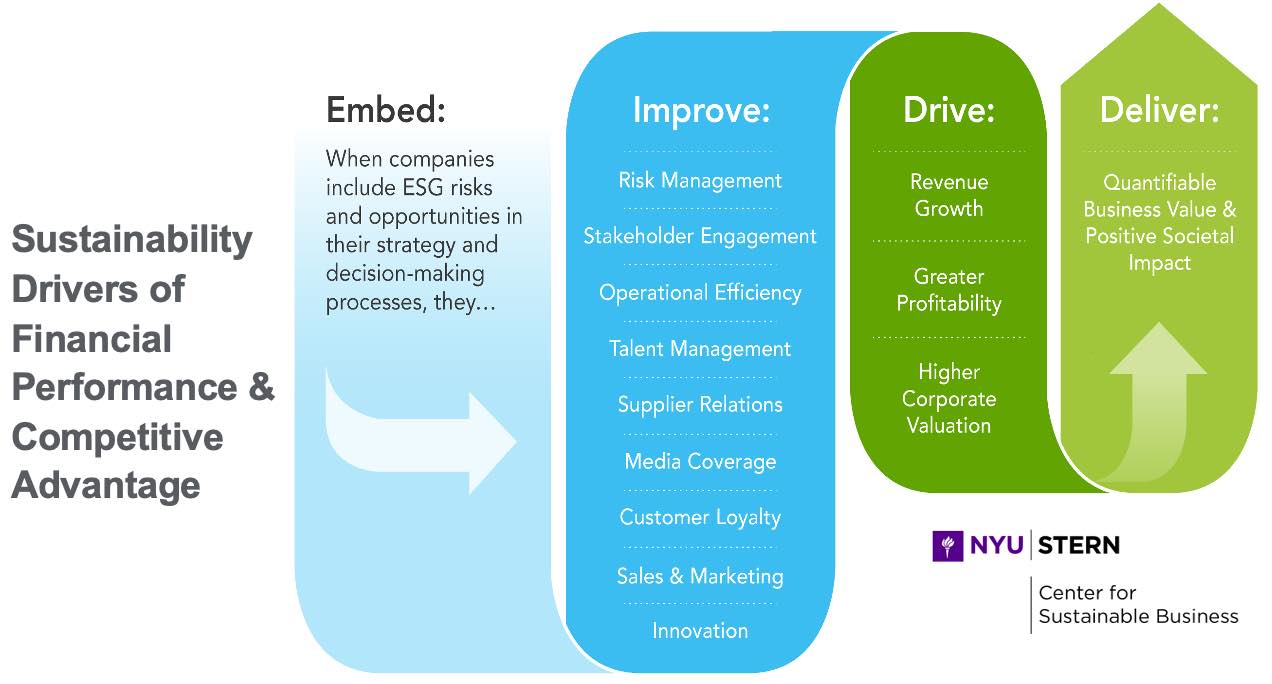

Practitioners and researchers struggle with valuing the return on sustainability investment (ROSI). We apply a five-step methodology that systematically monetizes sustainability actions to answer a key question: Do sustainable practices lead to a positive financial return for the business? We demonstrate the versatility of this methodology by monetizing potential and realized financial benefits via mediating factors (i.e., financial drivers) across two types of industries: Brazilian beef supply chains that committed to deforestation-free beef and the automotive industry, where companies were working to make manufacturing operations more sustainable. The companies participating in our cases found substantial value from implementing sustainability strategies. The beef supply chain yielded a potential net present value (NPV) between 0.01 percent to 12 percent of annual revenue, depending on the supply chain segment. For one automotive company, the five-year NPV based on realized benefits was 12 percent of annual revenue. Our ROSI methodology guides managers to better value sustainability’s financial benefits. Ultimately, monetizing sustainability can lead to a competitive advantage and shared value for multiple stakeholders.

Useful things

- Presentation and slide deck: link

- A series of Excel tools to help practitioner implement the methodology: Talent Attraction, Productivity, and Retention · Automotive Industry · Commodity Supply Chains

- The Review of Business editorial board and Munich Re awarded this article with “Best Paper” ($6,000) for its demonstration of how a publicly-traded firm can quantify the relative value of integrating sustainability-related initiatives in its core operations.

More content

- How ROSI and Harvard’s Impacted Weighted Accounts relate: report

- NYU Stern Center for Sustainable Business publishes published a range of case study based on ROSI.